Best Billing Software Systems in Ahmedabad

Efficient billing systems are at the heart of any successful business. Whether you’re running a retail store, a restaurant, or a service-oriented enterprise, having the right billing software can significantly enhance your operations. Ahmedabad, a hub of thriving businesses, demands top-notch billing solutions to keep up with its fast-paced growth. Enter BS Soft, the leading provider of cutting-edge billing software systems in Ahmedabad.

Why Do You Need Billing Software?

Billing software streamlines the process of generating invoices, tracking payments, and managing inventory, among other critical functions. Here are some key benefits of using billing software for your business:

- Time-Saving: Automates repetitive tasks, reducing manual effort and errors.

- Accuracy: Ensures precise calculations and error-free invoices.

- Inventory Management: Tracks stock levels and updates them in real time.

- Improved Customer Experience: Speeds up the checkout process and provides detailed receipts.

- Analytics and Reporting: Offers insights into sales, revenue, and customer trends.

Features of BS Soft’s Billing Software in Ahmedabad

BS Soft’s billing software systems are designed to meet the diverse needs of businesses in Ahmedabad. Here’s what makes our solutions stand out:

- User-Friendly Interface Our software features an intuitive and easy-to-navigate interface, ensuring that even non-technical users can operate it efficiently.

- Customizable Options Tailor the software to suit your specific business requirements, from invoicing templates to tax calculations.

- Multi-Platform Compatibility Access your billing system on desktops, tablets, and smartphones, ensuring flexibility and mobility.

- Integrated Payment Gateways Facilitate secure and seamless payment processing through multiple modes, including UPI, credit/debit cards, and net banking.

- Inventory Management Keep track of stock levels, set low-stock alerts, and manage suppliers effortlessly.

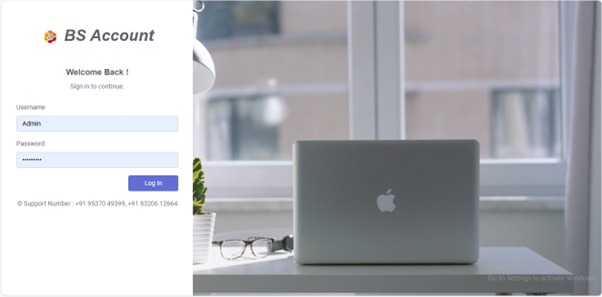

Login Page

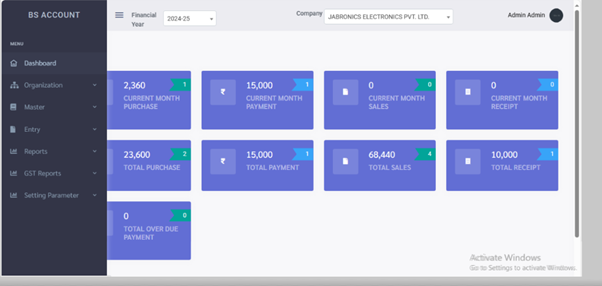

Dashboard

Here is a brief explanation of each dashboard module:

Monthly Transaction Modules

- Current Month Purchase

Displays the total value of purchases made by the organization during the current month. This includes goods or services acquired for operational or business needs. - Current Month Payment

Represents the total payments made by our Company to its suppliers, vendors, or service providers during the current month. These payments may be for purchases, invoices, or other dues. - Current Month Sales

Shows the total revenue generated from sales during the current month. This reflects the organization’s performance in terms of selling products or services in this period. - Current Month Receipt

Displays the total amount of cash or payments received from customers during the current month. This can include payments for sales, overdue payments, or advances.

Yearly Transaction Modules

- Total Purchase

Cumulative value of all purchases made by the organization in the ongoing financial year. This helps in understanding the yearly expenditure on acquiring goods or services. - Total Payment

Represents the total payments made by the organization throughout the financial year. This includes all settled invoices, supplier payments, and other financial transactions. - Total Sales

Shows the cumulative revenue generated from sales during the financial year. It provides an overview of the organization’s overall sales performance over the year. - Total Receipt

The cumulative total of all cash or payment inflows received during the financial year. This metric combines sales receipts, overdue payments, and other income.

Additional Module

- Total Overdue Payment

Reflects the total amount of payments that are overdue but still unpaid to the organization. This helps in identifying pending receivables that need to be addressed for better cash flow management.

Menu Box

Here is a brief explanation of each module:

- Dashboard

- Purpose: Provides a quick overview of financial transactions.

- Features:

- Displays monthly and yearly data for sales, receipts, purchases, and payments.

- Helps track the organization’s financial performance at a glance.

- Useful for identifying trends and comparing current activity with historical data.

- Organization

- Purpose: Manage user accounts and organizational details.

- Features:

- Create New User: Add new users to the system with roles and permissions.

- User List: View and manage existing users.

- Ensures proper access control and system security.

- Master

- Purpose: Centralized module for managing core organizational data.

- Features:

- Customer Management: Maintain a list of customers & Suppliers.

- Item Management: Maintain details of items/products.

- Other supporting data includes:

- Geographical Data: Country, State, City.

- Accounting Information: Ledger Groups, Tax, Payment Types.

- Item Categorization: Units, Item Groups.

- Provides a structured repository for managing critical master data.

- Entry

- Purpose: Facilitate transaction recording for day-to-day operations.

- Features:

- Sales & Sales Return: Record sales and handle returns.

- Purchase & Purchase Return: Track purchases and manage returned items.

- Payments & Receipts: Record outgoing payments and incoming funds.

- Journal Voucher: Log adjustments or non-cash transactions.

- Challan Voucher: Track goods dispatched without immediate billing.

- Proforma Voucher: Create draft invoices for preliminary purposes.

- Reports

- Purpose: Generate detailed financial and operational reports.

- Features:

- Ledger Report: View account-level details for reconciliation.

- Payable & Receivable Reports: Track outstanding payments and dues.

- Purchase & Sales Registers: Summarize purchase and sales activity for audit and analysis.

- Provides data-driven insights to aid decision-making.

- GST Report

- Purpose: Simplify compliance with GST regulations.

- Features:

- Includes reports related to GST filing such as GSTR-1, GSTR-3B, and other required formats.

- Ensures accuracy in tax calculations and assists with timely submission.

- Aids in resolving GST-related queries during audits.

- Setting Parameters

- Purpose: Customize forms and printing layouts for operational needs.

- Features:

- Tailor the sales entry and challan entry forms to match business requirements.

- Customize printing formats for invoices, challans, and other documents.

- Ensures that the system aligns with organizational workflows.

By organizing these modules effectively, the system ensures seamless management of transactions, compliance, and reporting, while offering customization to meet specific business needs.

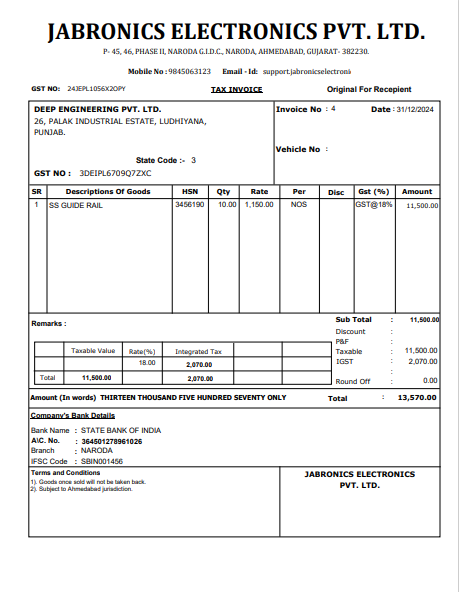

Sales Print

A Sales Voucher is a key document used to record sales transactions in accounting systems. It serves as a detailed record of goods or services sold, capturing critical financial information for accurate bookkeeping and reporting.

Key Features:

- Transaction Details:

Records essential information, including:- Invoice number, Invoice Date, Customer details, Items or services Details

- Pricing and Taxation:

- Item-wise pricing, quantity, and total amount

- Applicable taxes (e.g., GST) and tax breakup

- Discounts and Adjustments:

- Records any discounts, rebates, or adjustments applied to the sale.

- Integration:

Automatically updates related ledgers, such as Sales Account, Accounts Receivable. - Customization:

Fields can be tailored to include business-specific information like delivery details.

Sales Voucher with E-Way Bill and E-Invoice Facilities in Accounting Software

The Sales Voucher with E-Way Bill and E-Invoice Facilities is an integrated feature in accounting software that streamlines the process of generating sales invoices while ensuring compliance with tax and transportation regulations. This functionality enables the automatic creation of E-Way Bills (for goods transportation) and E-Invoices (for tax reporting), reducing manual efforts and enhancing the accuracy of sales transactions.

- Automatic E-Invoice Generation:

The system automatically generates an E-Invoice in compliance with government regulations (e.g., GST in India), which includes:- Unique Invoice Number

- GSTIN of buyer and seller

- Item details with tax classification

- HSN/SAC code

- QR Code and Digital Signature for validation

- E-Way Bill Generation:

On the creation of a sales voucher, the system automatically triggers the generation of an E-Way Bill, if applicable (typically for transactions involving the movement of goods worth above a certain threshold). The system captures:- Transporter details (if available)

- Vehicle number or transporter ID

- Origin and destination GSTIN

- Goods and quantity details

- Seamless Integration with Tax Calculation:

The software calculates taxes (such as GST) based on pre-defined rules and ensures they are correctly reflected in the generated E-Invoice and E-Way Bill. - E-Invoice and E-Way Bill Upload/Sharing:

The system can automatically upload the E-Invoice and E-Way Bill data to the respective government portal (e.g., GSTN portal) for validation and generation of unique identifiers (IRN for E-Invoice, E-Way Bill number). It also allows users to share these documents via email or print them for physical documentation. - Customization of Sales Voucher Formats:

Users can customize the layout and format of sales vouchers to match business requirements, while still ensuring E-Invoice and E-Way Bill compliance.

Benefits:

- Automated Compliance: Reduces the risk of errors and penalties by automating the generation of E-Invoices and E-Way Bills.

- Efficient Transaction Processing: Simplifies the entire process of sales entry, tax calculation, and document generation in one unified workflow.

- Time-Saving: Speeds up invoicing and logistics documentation, allowing for quicker shipment of goods and faster tax filing.

Workflow:

- Create Sales Voucher:

Enter details for the sale, including customer, item information, pricing, and taxes. - E-Invoice Generation:

Upon finalizing the voucher, the software automatically generates an E-Invoice and updates the government portal for IRN (Invoice Reference Number). - E-Way Bill Generation:

If the transaction involves transportation of goods, the system automatically generates an E-Way Bill, including all required transport details. - Validation and Upload:

The system validates and uploads the documents to the government portal. It receives the unique identifiers for both the E-Invoice (IRN) and E-Way Bill. - Document Sharing:

The E-Invoice and E-Way Bill can be printed for physical record-keeping or customer sharing.

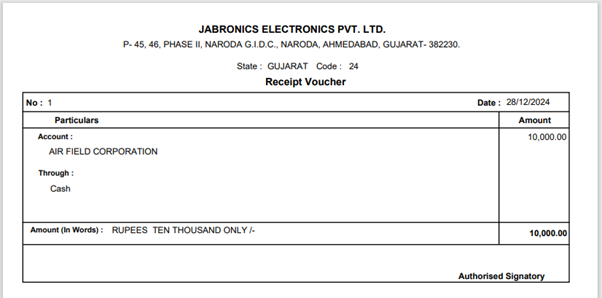

Receipt Print

A Receipt in Accounting is a document that serves as proof of payment received by a business from a customer or other party. It confirms that funds have been transferred and acknowledges the transaction.

Key Features:

- Transaction Details: Includes the date, receipt number, and payment amount.

- Payee Information: Records the name and details of the person or organization making the payment.

- Payment Mode: Specifies the method of payment (cash, cheque, credit card, bank transfer, etc.).

- Purpose of Payment: Describes the reason for the receipt, such as sales, rent, or repayment.

- Print Receipt: Allows the generation and printing of a professional receipt document for the payee, ensuring proper acknowledgment of the transaction.

- Total Amount: Displays the sum of all recorded receipts for easy reference.

- Remaining Amount: Shows the outstanding balance, helping track pending payments or dues.

Receipts are essential for maintaining accurate records, reconciling accounts, and ensuring transparency in financial transactions.

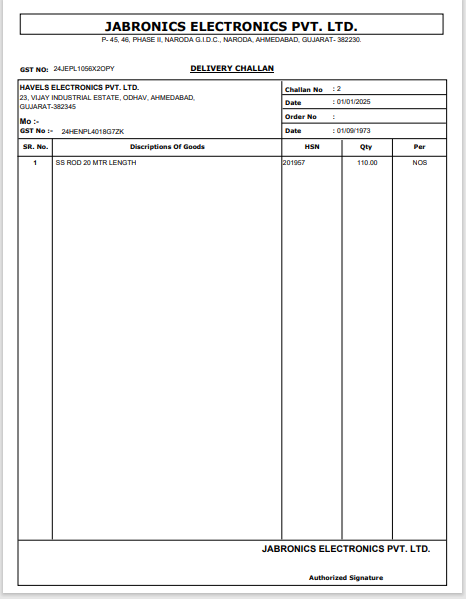

Challan Print

A Challan Voucher in accounting is a document used to record the delivery or dispatch of goods, either for sale, stock transfer, or other purposes. It acts as a supporting document to track the movement of goods and serves as proof of delivery.

Key Features:

- Purpose:

- Used for recording the transfer of goods to a customer, branch, or warehouse.

- May accompany goods during transportation as evidence of dispatch.

- Details Included:

- Date and Challan number for unique identification.

- Name and address of the sender and recipient.

- Description of goods, including quantity and unit.

- Types:

- Sales Challan: When goods are dispatched before raising an invoice.

- Delivery Challan: For non-sale purposes like samples or returns.

Challan vouchers ensure proper tracking of goods movement and facilitate reconciliation between dispatch and delivery records.

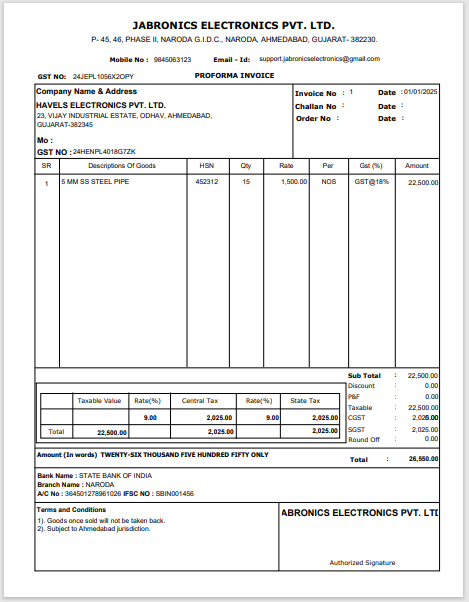

Proforma Print

A Proforma Voucher in accounting is a preliminary document used to record a transaction that is yet to be finalized or paid. It provides an estimate of the costs or details of the transaction but is not a formal financial entry until the actual payment or formal invoice is received.

- Purpose:

- Used to outline and confirm the details of a transaction before the finalization of payment or invoicing.

- Helps in preparing for the final voucher once the transaction is fully confirmed or completed.

- Details Included:

- Date of the proforma voucher.

- Vendor or supplier details (name, address).

- Description of goods or services to be procured.

- Estimated costs, including taxes, discounts, or additional charges.

- Temporary Nature:

- It is not a final accounting entry and does not affect financial ledgers.

- Used as a reference for future formal documentation (e.g., final invoices, payment vouchers).

Why Choose BS Soft in Ahmedabad?

As a trusted name in billing software solutions, BS Soft has earned the confidence of countless businesses in Ahmedabad. Here’s why we’re the preferred choice:

- Local Expertise: With a deep understanding of the Ahmedabad market, we deliver solutions tailored to local business needs.

- Affordable Pricing: Our software systems are competitively priced to ensure value for money.

- Reliable Support: We offer dedicated customer support to assist with installation, troubleshooting, and upgrades.

- Scalable Solutions: Whether you’re a small business or a large enterprise, our software grows with you.

Testimonials from Satisfied Clients

“BS Soft’s billing software has transformed the way we handle our invoices. The GST compliance feature is a lifesaver for our accounting team!” – Rajesh Patel, Retailer in Ahmedabad

“Thanks to BS Soft, our restaurant’s billing process is now faster and error-free. The reporting tools are incredibly insightful.” – Neha Sharma, Restaurant Owner

Contact Us

Ready to upgrade your billing system? Contact BS Soft today to learn more about our offerings and request a demo. Let us help you take your business to the next level!